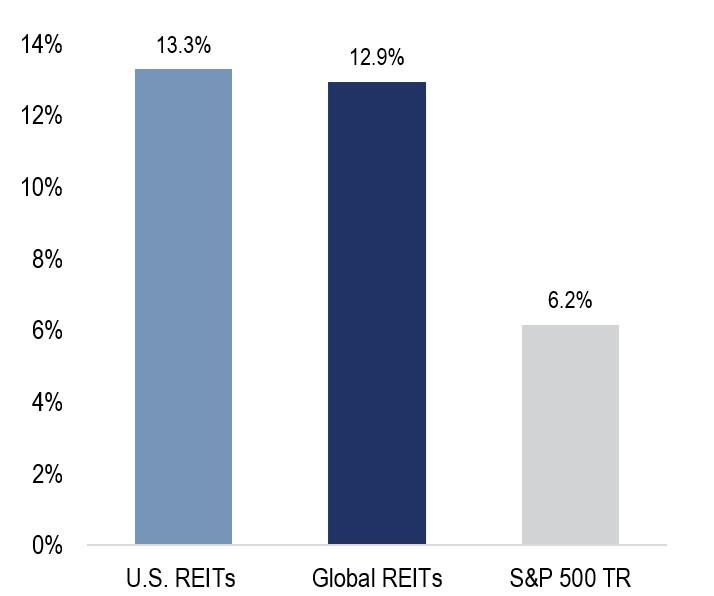

While markets continue to be driven by expectations of continued Fed rate cuts, investors must consider why the current backdrop may present an attractive entry point for publicly-traded real estate (REITs). Investors are warming to the idea that the first two rate cuts represent the catalyst for them to increase their allocation to listed real estate, as REITs have historically performed remarkably well when rate-hiking cycles have ended. Over the last 30 years, when the Fed has stopped raising rates, U.S. REITs have returned, on average, 13.3% and Global REITs have returned 12.9% over the first six months after the Fed’s hiking rates (see chart below).

Uncertainty around when and how many Fed rate cuts were likely to occur in 2024 and 2025 created elevated market volatility in the first half of 2024. Now that the U.S. Fed has made its first two rate cuts, REITs have an additional tailwind at their backs.

What is an Appropriate Allocation to REITs?

The answer will vary based on each investor’s investment objectives, risk tolerance, and time horizon, but below are some key insights that may help in determining the appropriate allocation for REITs within a diversified portfolio:

Historic Performance Last 30 Years |

|

| Returns represent the average after hiking period cycles covering April 1995-September 1995, July 2000-December 2000, September 2006-February 2007, and March 2019-August 2019. U.S. REITs are represented by the FTSE Nareit All Equity REITs Index. (Global REITs are represented by the FTSE EPRA Nareit Developed Index. |

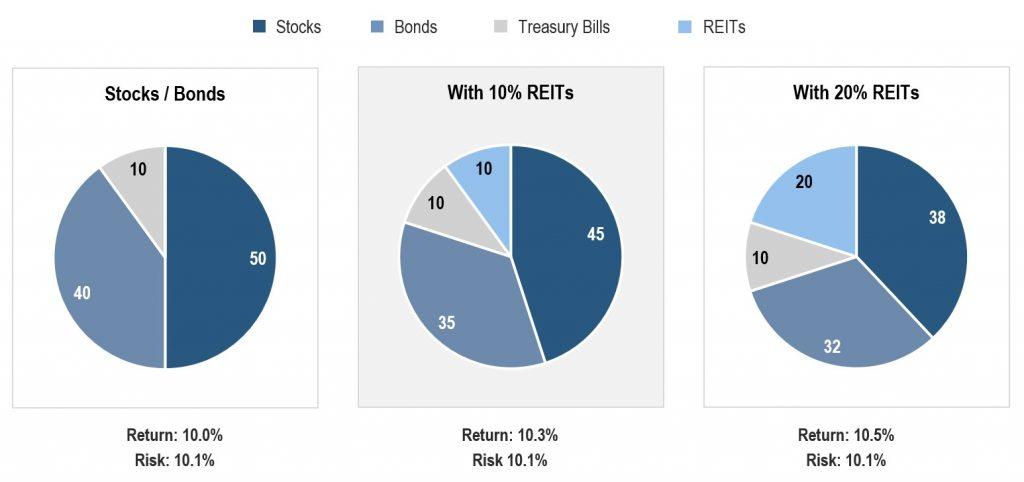

- Multiple research studies have found that the optimal portfolio allocation to REITs is between 5% and 15% of a portfolio’s total assets.1

- David F. Swensen, PhD, noted former CIO of the Yale endowment and author of Unconventional Success: A Fundamental Approach to Personal Investment, recommends a 15% allocation to REITs in his model portfolio for investors.

- Further insight comes from Chatham Partners’ research, a leading market research firm, which found that advisors recommend allocations to REITs in the range of 4% to 12% – irrespective of the client’s age – from early career to in retirement.2

- Roger Ibbotson, Professor Emeritus in Practice of Finance at the Yale School of Management, found that allocating at least 5% of your portfolio to real estate securities leads to greater returns and comes with lower overall portfolio risk compared with a traditional 60% equity and 40% bond portfolio. These findings support the abundance of academic literature on asset allocation, which maintains that real estate should account for 5% to 20% of a mixed-asset portfolio.3

The Role of REITs in a Portfolio4

Potential to increase returns (1972-2016)

Why Invest in High Conviction Portfolios?

In order to outperform the market, one must invest in high-conviction portfolios which differ from the benchmark index (i.e., portfolios with high active share). During periods when exogenous, non-fundamental factors such as macroeconomic uncertainty and/or geopolitical stress distract investors from market fundamentals, portfolios with high active share may underperform the market. Historically, investors eventually returned their attention to industry and company fundamentals, whereupon high-conviction portfolios have outperformed the market.

Over the last 15 years, there have been seven episodes in which the market has been distracted away from fundamentals by exogenous (either macroeconomic and/or geopolitical) factors for transitory periods of time. In each of these periods, the market inevitably returned its attention back to fundamentals with each of the six previous periods representing attractive entry points for long-term investors in listed real estate.5

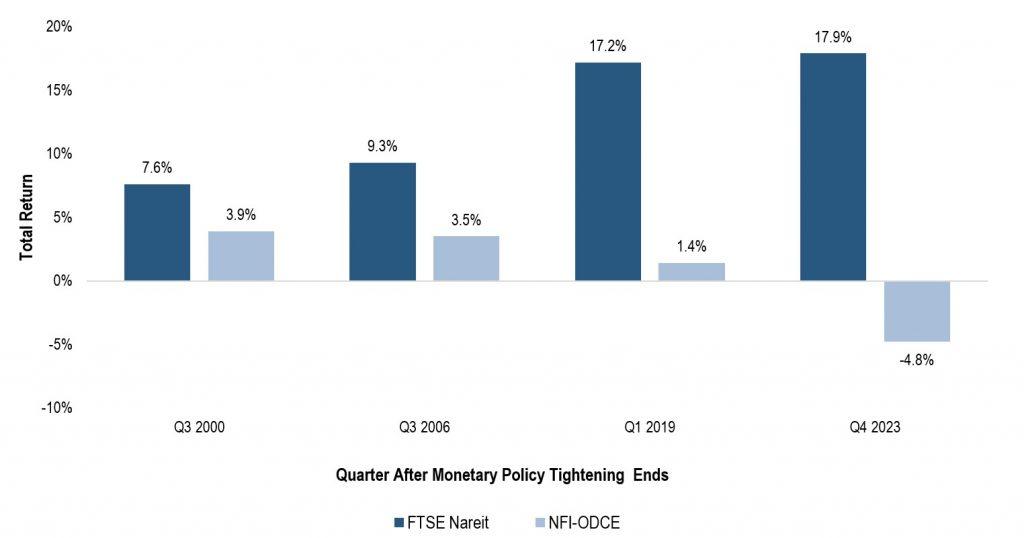

Return Differential Between REITs and Private Real Estate Following Fed Tightening Cycles Ending

On average, across the one-, two-, and four-quarter time horizons following the end of the three rate hike cycles since 1999, REITs outperformed private real estate. The performance gap has widened in more recent periods, with the FTSE Nareit All Equity Index outperforming the NCREIF Fund Index by 22.7% in the quarter immediately following the most recent tightening cycle that ended in Q3 2023. This is attributable to the significant valuation gap between public and private real estate, with REIT-implied cap rates exceeding private appraisal cap rates by 216 basis points as of Q3 2023. As this valuation divergence begins to converge, likely through rising REIT valuations, we expect REITs to continue outperforming private real estate through 2024 and into 2025.

Performance After Monetary Policy Ends (Following Quarter)6

Conclusion

Despite the lingering macroeconomic uncertainty and geopolitical stress making headlines, the outlook for the REIT market is increasingly constructive. Real estate fundamentals and earnings growth (in most property sectors) remain healthy amidst an environment characterized by low supply of new space paired with strong occupancy rates and high construction costs. For the remainder of 2024 and well into 2025 we believe that REITs are poised to benefit from the beginning Fed easing, attractive valuations when compared to private real estate, and strong balance sheets which allows for opportunistic acquisitions.

Our high conviction, benchmark-agnostic investment approach allows us to be highly focused on identifying and owning what we believe are the 50 highest-quality companies in our investable universe. We have strong confidence in our fundamental research and seek to own companies with the best management teams in the industry. While global capital markets continue to experience transitory periods of market distraction by non-fundamental factors, we believe that our portfolio is well positioned as investor attention inevitably returns to fundamentals.

About the Author

Andrew J. Duffy, CFA is Chief Investment Officer and Senior Portfolio Manager of Easterly Investment Partners. Andrew has over 30 years of experience as an investor in global real estate securities. He has been the Senior Portfolio Manager of the Easterly Global Real Estate Fund since its inception in 2009.

Prior to 2009, Mr. Duffy was a Managing Director with Citigroup Principal Strategies, where he established and managed the proprietary liquid global real estate securities.

From 2009 to 2016, he was the President of Ascent Investment Advisors, LLC. Prior to 2009, Andrew was a Managing Director with Citigroup Principal Strategies, where he established and managed the proprietary liquid global real estate investment business which included a long-short portfolio of global real estate securities. Previously, he was the Co-Portfolio Manager of the Hunter Global Real Estate Fund, and from 1999 until 2006, he was a Portfolio Manager at TIAA-CREF, where he established the liquid global real estate investment business and team, which ultimately managed over $3.5 billion in global real estate equity and debt securities. Between 1993 and 1999, he was a Senior Research Analyst at Eagle Asset Management, where he launched and managed a dedicated real estate securities investment program with responsibility for fundamental analysis, securities selection, and portfolio construction. Prior to that, Andy served as a Partner at Raymond James & Associates where, as an investment banker, he managed public offerings and advised on mergers and acquisitions.

About Easterly

Easterly Asset Management and its Strategic Partners provide private wealth and institutional investors with a portfolio of solutions across alternatives, active equity and active fixed income. Founded in 2019, Easterly’s goal is to bring curated solutions to clients that make their portfolios better by partnering with trusted investment teams who have an established track record of delivering value to investors. Easterly enables high-performing managers to operate at scale by delivering best-in-class resources, risk management, operational support, infrastructure and an institutional and wealth distribution team. As of June 30, 2024, Easterly and its Strategic Partners manage approximately $60B of client assets. For more information, visit easterlyam.com.

1Source: REIT performance studies: Ibbotson Associates, Morningstar, and Wilshire Funds Management.

2Source: Nareit sponsored REIT Utilization Study of 349 financial advisors by Chatham Partners, LLC, March 2021

3Source: https://www.morningstar.com/funds/role-real-estate-investments-portfolio

4Source: https://www.reit.com/sites/default/files/media/DataResearch/RoleofREITsSheet4-13.pdf

5Source: Morningstar Direct. Fund performance since inception in October 2009 and utilized the FTSE EPRA Nareit Developed Index as a proxy for the listed real estate market

6Sources: Pension Real Estate Association, 2024 (PREA), Federal Reserve Board, Nareit, NCREIF

Defined Terms

FTSE Nareit All Equity REITs Index (FTSE Nareit): an Index comprised of publicly‐traded real estate securities in the U.S. which have met certain financial criteria for inclusion in the Index. Each company must derive the bulk of its earnings through the ownership, management, or development of income‐producing commercial real estate.

NCREIF Fund Index (NFI-ODCE): a capitalization-weighted, gross of fee, time-weighted return index invested in private equity direct real estate.

20241003-3904297

20241007-3915157